Fuel Switch Snapshot: LNG rises towards VLSFO

Singapore’s LNG bunker price soars

Bio-premiums over LNG narrow substantially

VLSFO benchmarks remain stable

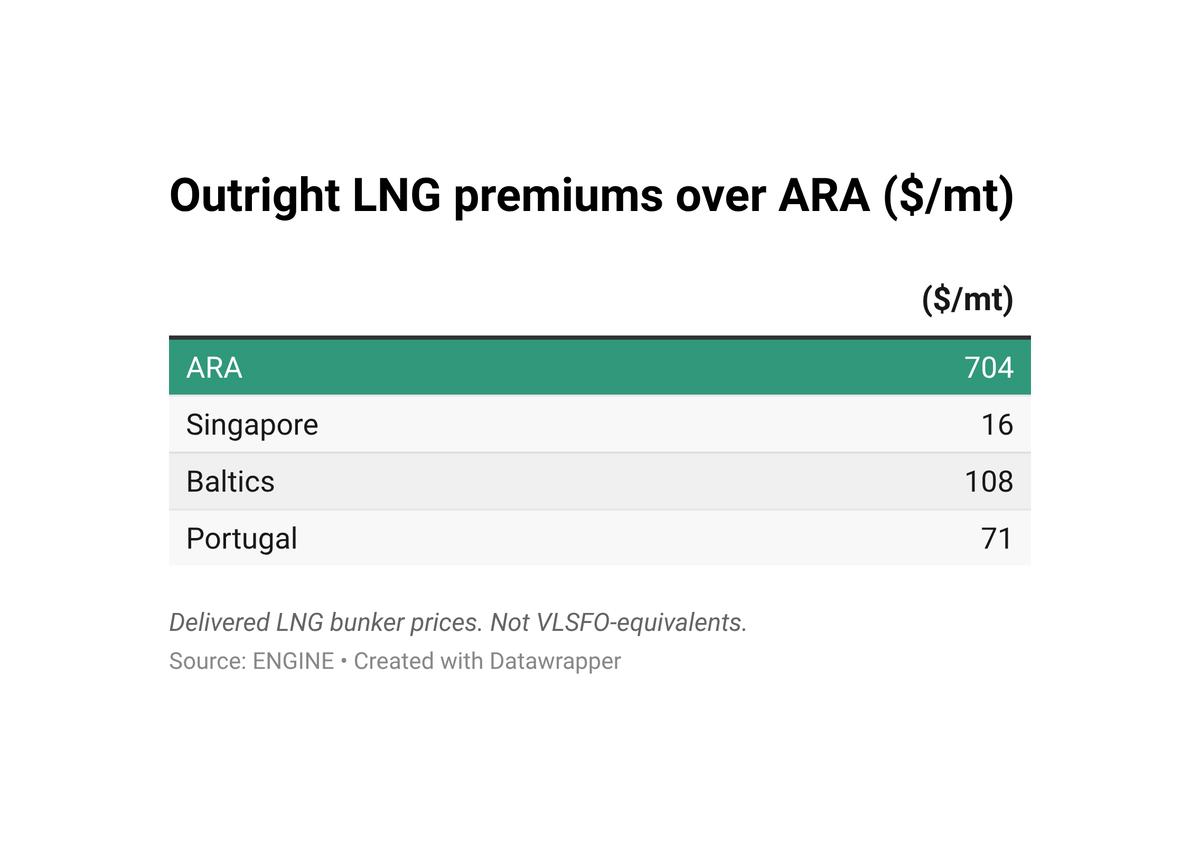

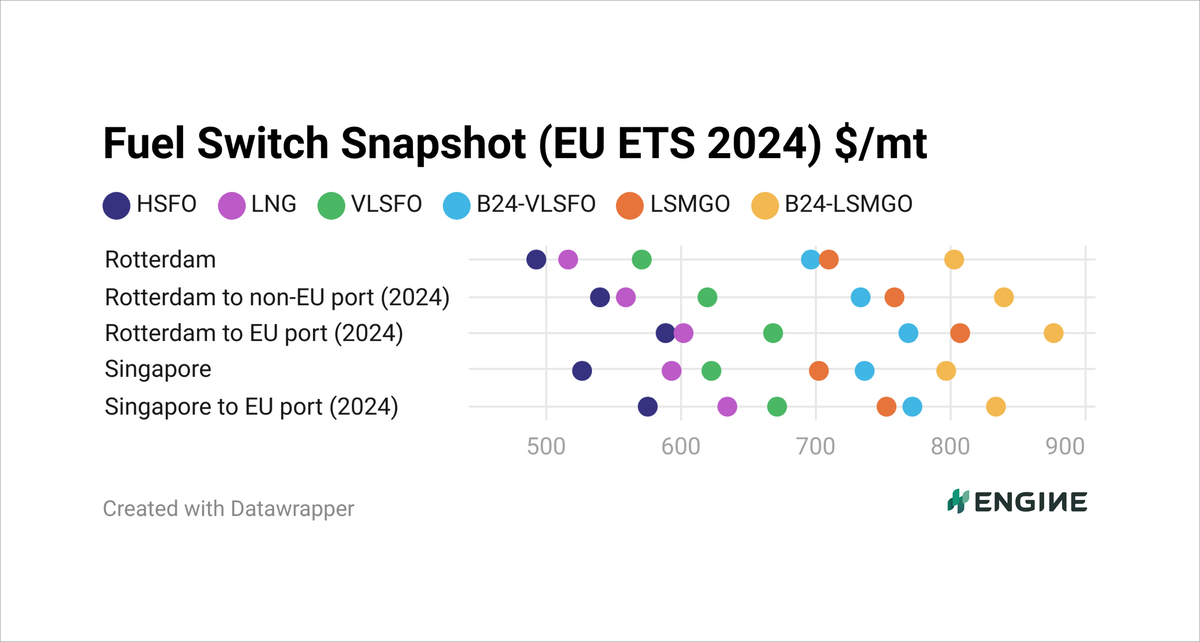

CHART: The dots represent bunker fuel prices adjusted for calorific contents to become VLSFO-equivalents, and with various estimated levels of EU ETS costs excluded (Rotterdam) and included (Rotterdam to non-EU port and Rotterdam to EU port). ENGINE, PRIMA Markets, NYMEX

CHART: The dots represent bunker fuel prices adjusted for calorific contents to become VLSFO-equivalents, and with various estimated levels of EU ETS costs excluded (Rotterdam) and included (Rotterdam to non-EU port and Rotterdam to EU port). ENGINE, PRIMA Markets, NYMEX

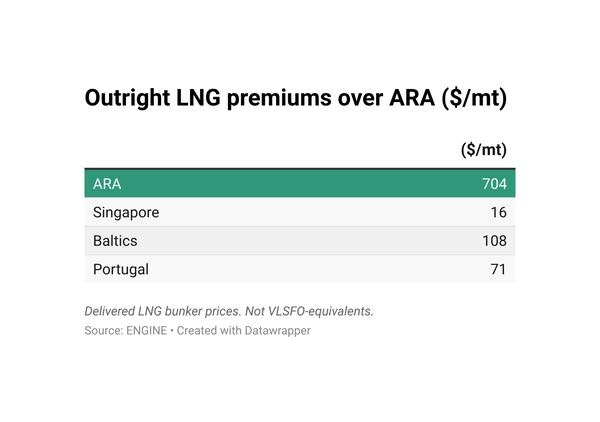

Rotterdam's fossil LNG bunker price has edged closer to its VLSFO by $7-8/mt over the past week, now making it $54-66/mt cheaper than VLSFO.

The price gap between LNG and VLSFO has narrowed even further by $34/mt in Singapore because of the sharp rise in LNG bunker price. LNG bunker price in Singapore is now at a $30-36/mt discount to its VLSFO, depending on whether the estimated EU Allowance (EUA) costs are added to their bunker fuels costs.

Singapore’s biofuel price premiums over fossil LNG has narrowed by $41/mt to $142/mt in the past week. In Rotterdam, the bio-bunker premium over LNG has narrowed by $14/mt to $179/mt.

B24-VLSFO price premiums over pure VLSFO are $125/mt in Rotterdam and $113/mt in Singapore.

VLSFO

Rotterdam’s VLSFO benchmark inched $1/mt lower in the past week. When we add estimated EUA costs, there is only a slight decline of $1-2/mt, depending on whether we are looking at voyages between EU ports or between EU ports and non-EU ports.

VLSFO availability remains good in the wider ARA hub. Lead times of 3-5 days are currently advised for the grade in Rotterdam, down from 4-5 days seen earlier, a trader said.

Singapore’s VLSFO benchmark also remained relatively steady in the past week, with a modest $4/mt decline.

VLSFO availability has improved in Singapore, with most suppliers suggesting lead times of 4-7 days, much shorter than the previous week's 6-12 days.

Biofuels

Rotterdam’s B24-VLSFO HBE bunker price has moved $8/mt lower in the past week.

Prices for palm oil mill effluent methyl ester (POMEME) have declined by $25/mt to $1,298/mt in the past week. This has partly contributed to the bio-bunker price declines in Rotterdam. POMEME-based biofuels can qualify for advanced biofuel rebates through the Dutch HBE system.

Singapore’s B24-VLSFO UCOME bunker price has declined by $11-12/mt in the past week, depending on whether the price is adjusted with estimated EUA costs.

The prices have come down amid a $30/mt drop in UCOME FOB China prices, which is down because of weak demand from the EU.

LNG

Rotterdam’s LNG bunker benchmark has seen a modest $6-7/mt gain in the past week, depending on whether estimated EU ETS costs are included in the cost of fuel. The gains have mirrored increases in the front-month NYMEX Dutch TTF Natural Gas benchmark.

Despite the EU's gas storage levels being full at 67%, which is higher than last year, the TTF benchmark has increased. Analysts predict that Europe will head into the next winter with full storage, potentially leading to lower prices, head of commodities strategy at ING Warren Patterson said.

Singapore’s LNG bunker price has surged by $29-30/mt in the past week. This steeper increase is partly linked to the underlying NYMEX Japan/Korea Marker contract (JKM), which has rolled from the June to the higher-priced July contract, elevating the JKM benchmark and bunker prices.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online