Fuel Switch Snapshot: Bio-blends now cheaper than LNG in Singapore

LNG now one of the priciest bunker options in Singapore

Singapore’s LNG flips to a premium over B24-VLSFO

Rotterdam’s B24-VLSFO priced $62/mt higher than LNG

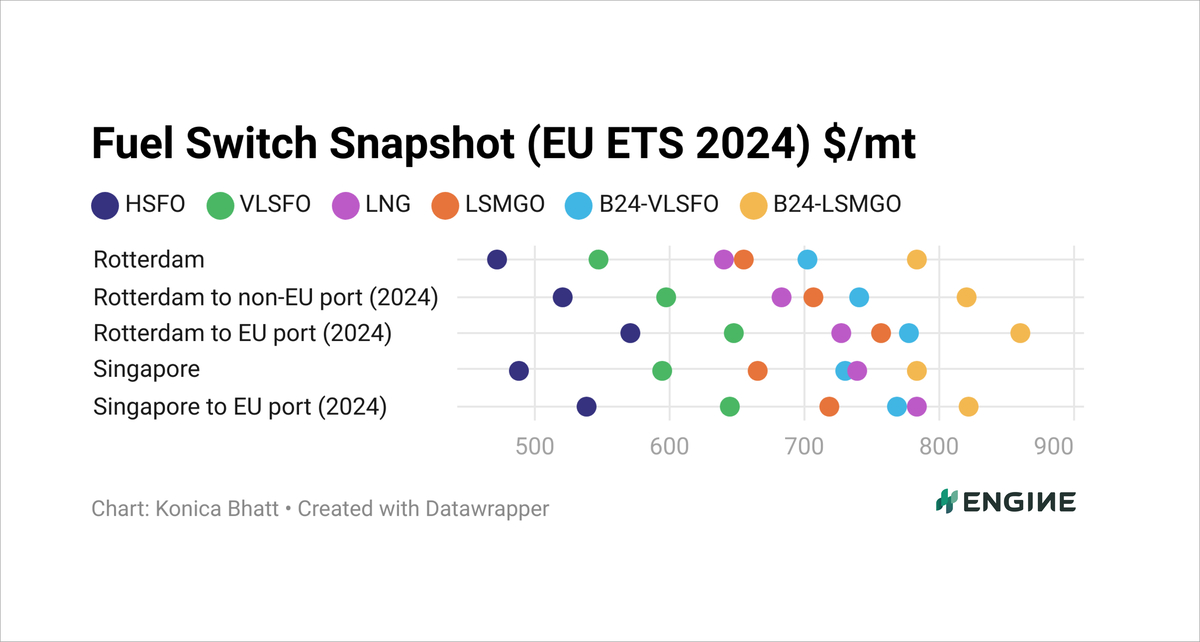

CHART: The dots represent bunker fuel prices adjusted for calorific contents to become VLSFO-equivalents, and with various estimated levels of EU ETS costs in 2024 excluded (Rotterdam) and included (Rotterdam to non-EU port and Rotterdam to EU port). ENGINE, PRIMA Markets, NYMEX

CHART: The dots represent bunker fuel prices adjusted for calorific contents to become VLSFO-equivalents, and with various estimated levels of EU ETS costs in 2024 excluded (Rotterdam) and included (Rotterdam to non-EU port and Rotterdam to EU port). ENGINE, PRIMA Markets, NYMEX

B24-VLSFO blend is now cheaper than fossil LNG in Singapore. Fossil LNG has become the second-costliest bunkering alternative among conventional, B24 blends and LNG in Singapore, following a sharp price rise over the past week. These bunker prices all include estimated EU Allowances (EUAs) for comparison.

Singapore's VLSFO-equivalent LNG price has shifted from an $81/mt discount to B24-VLSFO, to a $9/mt premium over B24-VLSFO now. When adding estimated EUA costs, LNG is now $14/mt more expensive than the bio-blend.

Singapore's LNG price has flipped from a $16/mt discount to LSMGO a week ago, to a massive $73/mt premium now. When factoring in estimated EUA costs to an EU port, Singapore’s LNG is $65/mt more expensive than its LSMGO.

This means that dual-fuel shipowners can now bunker UCOME-based B24-VLSFO blends ,or pure VLSFO or LSMGO stems, in Singapore at lower costs than LNG.

VLSFO

VLSFO benchmarks in Rotterdam and Singapore have remained largely steady over the past week, as Brent futures have seen little change.

Rotterdam’s VLSFO price has inched up by $2/mt. The grade is available for prompt delivery dates and demand has been good in the past week, a trader said.

Singapore’s VLSFO price has dipped by $3/mt amid expectations of ample supply. Some suppliers expect replenishment stocks to arrive towards the end of this month, which could boost supply in the port, a source told ENGINE.

Biofuels

Bio-bunker prices in Rotterdam and Singapore have remained mostly steady over the past week.

Rotterdam’s B24-VLSFO HBE price has fallen by $6/mt, and B24-LSMGO HBE by $7/mt. Palm oil mill effluent methyl ester (POMEME) is a key feedstock for these HBE blends, and the price of POMEME has held steady at $1,331/mt in the ARA region.

Singapore’s B24-VLSFO and B24-LSMGO prices have both edged $4/mt lower. PRIMA has assessed the UCOME FOB China benchmark to $970/mt, which is down by $10/mt on the week. This has added downward pressure on UCOME-based biofuel prices in Singapore, where suppliers look to China for imports of finished biofuel and bio feedstock.

LNG

Rotterdam's VLSFO-equivalent LNG bunker price has remained relatively stable, with only a $3/mt decline recorded over the past week.

In contrast, Singapore's price has shot up by $80/mt in the past week.

Singapore's increase follows a rollover of the NYMEX Japan/Korea Marker (JKM) contract from September to the higher-priced October contract, which lifted the JKM benchmark and pushed up bunker prices.

Adding to this upward pressure are forecasts of above-average temperatures across East and Southeast Asia. As temperatures soar, demand for gas-fired electricity to power cooling systems is expected to spike.

Singapore's LNG bunker benchmark is now $99/mt higher than Rotterdam’s.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online