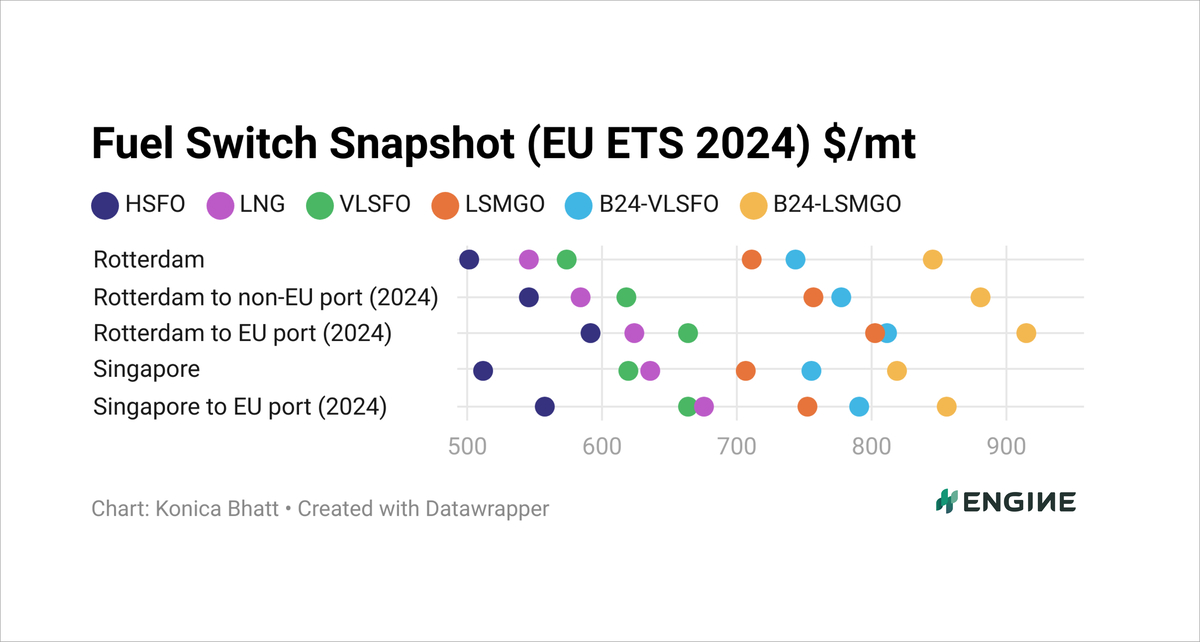

Fuel Switch Snapshot: HSFO remains cheapest across hubs

Brent's steep fall brings VLSFO down

Singapore premiums over Rotterdam narrow

EU to impose tariffs on Chinese biodiesel imports

CHART: The dots represent bunker fuel prices adjusted for calorific contents to become VLSFO-equivalents, and with various estimated levels of EU ETS costs in 2024 excluded (Rotterdam) and included (Rotterdam to non-EU port and Rotterdam to EU port). ENGINE, PRIMA Markets, NYMEX

CHART: The dots represent bunker fuel prices adjusted for calorific contents to become VLSFO-equivalents, and with various estimated levels of EU ETS costs in 2024 excluded (Rotterdam) and included (Rotterdam to non-EU port and Rotterdam to EU port). ENGINE, PRIMA Markets, NYMEX

A sharp drop of $2.40/bbl ($18/mt) in front-month Brent futures has pushed down conventional fuel prices for yet another week.

Bio-blend prices have also declined amid decreases in both bio- and conventional fuel components.

Rotterdam’s VLSFO-equivalent LNG benchmark has bucked the downward trend and inched up by $3/mt in the past week.

LNG bunker fuel is priced $16/mt higher than VLSFO in Singapore, making VLSFO the cheaper option for dual-fuel vessels bunkering there. Conversely, LNG is the more cost-effective choice for dual-fuel ships bunkering in Rotterdam.

The ARA’s B24-VLSFO UCOME price premium over Singapore’s has widened from $19/mt to $32/mt as Singapore’s price has dropped.

VLSFO

VLSFO demand has improved slightly in the ARA in the past week, following slow activity the week before, a trader said. This seems to have prevented Rotterdam’s VLSFO benchmark from following Brent's significant decline.

Singapore’s VLSFO benchmark has tracked more of the crude benchmark's price drop, slipping by $14/mt in the past week. Most suppliers recommend lead times of up to 14 days for VLSFO in the port, but some can manage deliveries within five days.

When factoring in estimated EUA costs, Rotterdam’s VLSFO price has declined by $7-9/mt, while Singapore’s price has fallen by $16/mt.

Biofuels

Singapore’s B24-VLSFO UCOME price has declined by $7/mt in the past week, while its B24-LSMGO UCOME price has fallen by $9/mt. The two bio-bunker benchmarks have declined amid declining values for pure VLSFO ($4/mt) and LSMGO ($9/mt).

On Friday, the European Commission announced that it will impose provisional duties of up to 36.4% on biodiesel imports from China. PRIMA said “the EU anti-dumping results and its associated duties (ADDs) have effectively killed off Chinese biodiesel trading prospects into Europe”.

A lack of EU demand for Chinese biodiesel could result in more Chinese UCOME being exported to meet demand in countries like Singapore, sources say.

Rotterdam’s B30-VLSFO HBE price has declined by $8/mt in the past week, while its B30-LSMGO HBE price has dropped by a greater $14/mt. A $32/mt drop in the ARA POMEME price assessed by PRIMA Markets has pulled both benchmarks lower.

Biofuel price premiums over pure conventional fuels in Rotterdam are $189/mt for B30-VLSFO HBE blends and $136/mt for B30-LSMGO HBE blends. These premiums have narrowed by $9-12/mt in the past week.

The EU’s provisional duties on Chinese biodiesel imports could tighten availability of bio feedstocks for bio-bunker blending across Europe.

LNG

Rotterdam’s LNG bunker price has risen by $22/mt to $652/mt in the past week. The price rise has tracked an increase in the front-month NYMEX Dutch TTF Natural Gas contract.

The upward trend can be attributed to supply concerns at the Freeport LNG export terminal on the US Gulf Coast, a major source of European LNG supply. Some 5.4% of Europe's total LNG imports last year came from Freeport LNG.

Several LNG cargoes from Freeport LNG were held back from being exported by supply disruptions caused by Hurricane Beryl. This has contributed to push Rotterdam's LNG price higher in the past week.

Singapore's LNG bunker price has decreased by $11/mt, driven by a falling NYMEX Japan/Korea Marker (JKM) price.

The JKM price increased some in the middle of last week due to active deals to meet summer demand, before falling amid ample supply and high inventory levels, according to a report by the Japan Organization for Metals and Energy Security (JOGMEC).

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online