Lower LNG prices spark oil-to-gas switching in Singapore

Fuel switching has become more prevalent in Singapore as LNG outcompetes VLSFO on price, according to industry experts.

Tankers equipped with dual-fuel engines capable of using both VLSFO and LNG are actively engaging in fuel switching, an analyst at Kpler told ENGINE.

“There has been an increase in fuel switching in the past month, so vessels that have predominantly been using VLSFO are now switching to LNG in Singapore," another trading source said.

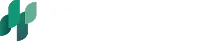

Singapore’s LNG bunkering sales reached a new record in the first four months of this year, with sales totaling 111,000 mt from January to April, according to data from the Maritime and Port Authority of Singapore.

This is significantly higher than 12,000 mt sold in the same period last year.

Meanwhile, Singapore’s VLSFO sales dropped by 3% to 10.1 million mt in the first four months of this year, compared to the same period last year.

Factors driving the shift

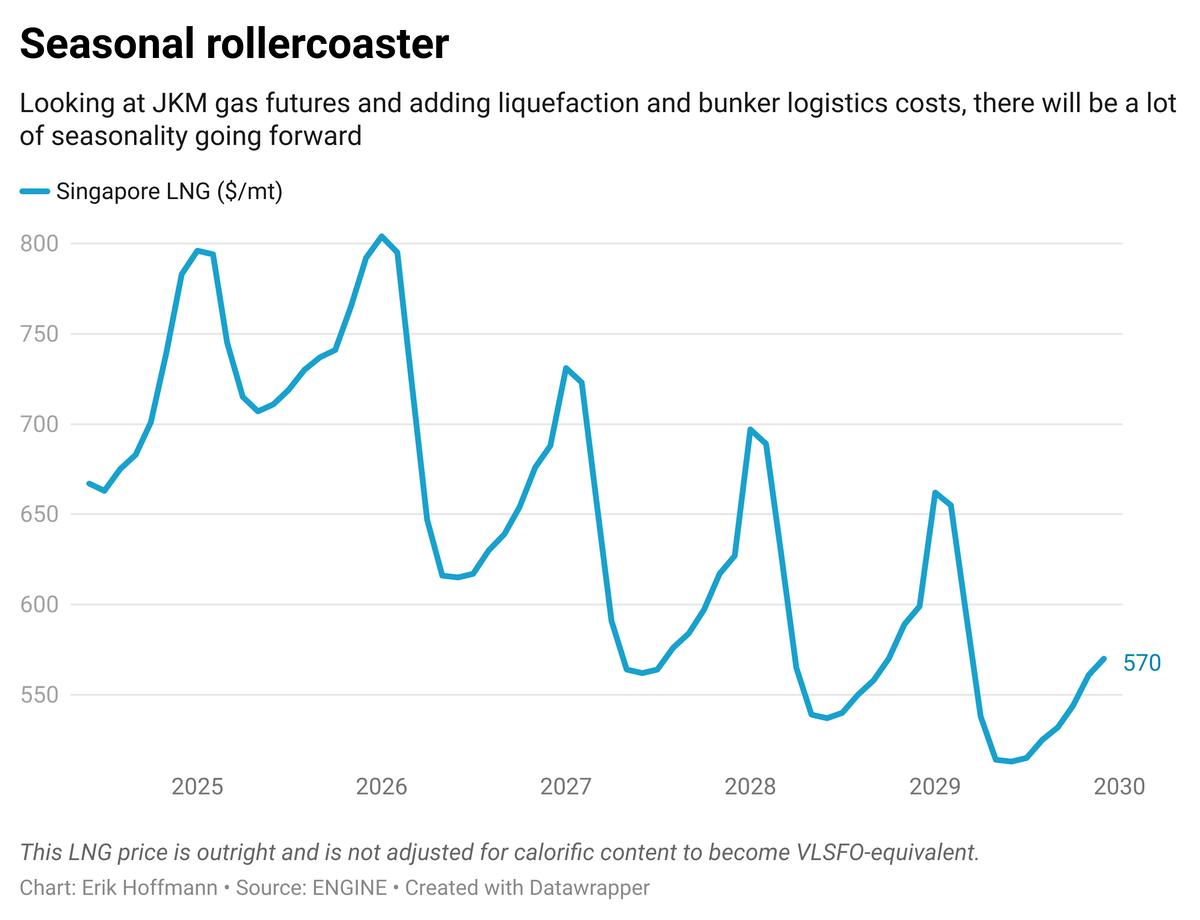

Confidence in LNG as a bunker fuel has grown because of lower prices, which is partly because of a lower Japan Korea Marker gas price benchmark and reduced bunker delivery costs. Bunker delivery costs dropped from around $3.00/million British thermal units (MMBtu) to around $2.50/MMBtu last month, a trader said.

One of the main reasons for lower JKM prices is reduced LNG demand in Japan and Korea, driven by increased utilisation of nuclear power. These two key regional importers have imported less LNG cargo volumes, which has freed up LNG in favour of Singapore.

In the first three months of 2024, Japanese LNG imports were down by 3.5% year-on-year to 18.1 million mt, while South Korean imports decreased by 10.7% to 12.7 million mt, according to Kpler cargo tracking data.

By contrast, Singapore's LNG imports surged by 53.4% over this period.

More broadly, well-above-average US gas stocks and robust European gas storage levels have also underpinned a more ample global gas supply picture.

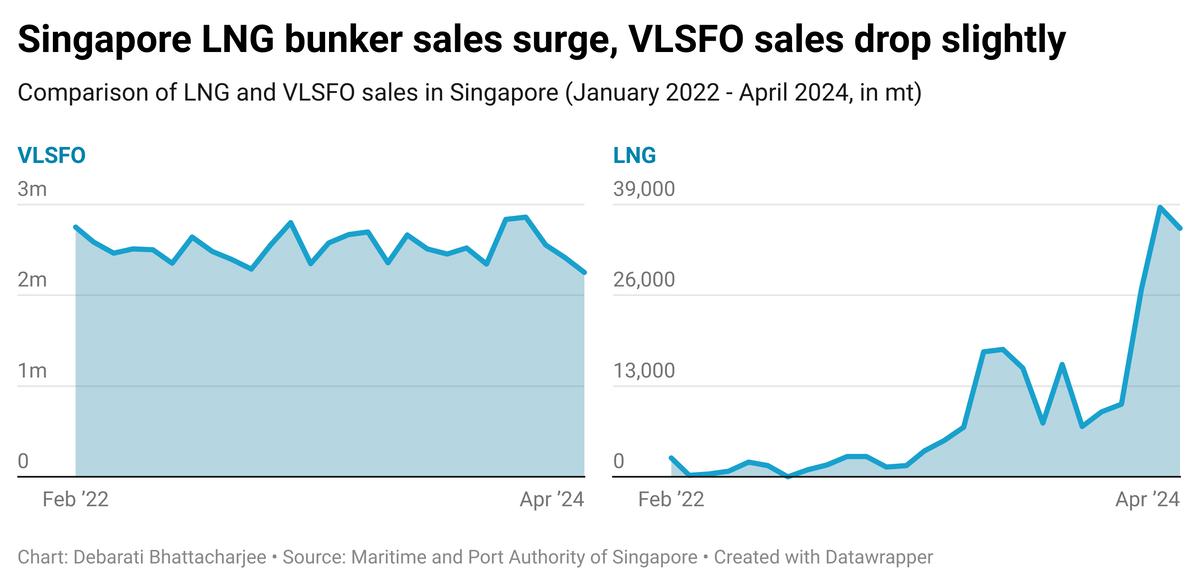

Gas is seasonal

Less gas demand in the shoulder months between summers and winters has historically led to lower LNG prices, which makes it important to time LNG purchases, a trader said.

The Singapore LNG futures graph shows a yearly pattern where LNG prices reach their highest around January and their lowest around June-July. Demand for natural gas rises during winter months when people in the northern hemisphere require more gas for heating, and during the summer when people in the northern and middle parts of the planet use more power for airconditioning.

Peak winter heating demand typically reduces gas storage levels and pushes up gas prices. But this past winter was different. From mid-December, Singapore's LNG futures price started to drop due to an increase in LNG imports that led to ample supply.

Last November, Singapore's LNG bunker price was over $900/mt, but coming into December it fell below $800/mt, making it cheaper than LSMGO in the port.

At the time LNG was still about $100/mt more expensive than VLSFO, but by January it had dropped to a discount to VLSFO, which is has held since.

LNG is now at a $57/mt discount to VLSFO and a $137/mt discount to LSMGO in Singapore.

Short window

“There’s a definite opportunity for LNG to displace some fuel oil demand in the short term," Sparta Commodities analyst Samantha Hartke told ENGINE.

“However, the JKM LNG market's contango structure from July hints at a narrow price advantage window, suggesting a potential shift in market dynamics in the near future,” she added.

By Debarati Bhattacharjee

Please get in touch with comments or additional info to news@engine.online